Home renovations add both comfort and value to your property—whether it’s new hardwood floors, fresh landscaping, or even a full addition. The challenge is that renovations aren’t cheap, and many homeowners put off projects because of the upfront cost. The good news? There are strategic ways to make the investment easier. In this guide, we’ll explore how to finance home renovations through smart planning, cost reduction, and flexible payment options that help you move forward with confidence.

Start with Multiple Quotes

Getting multiple quotes for any home renovation project should always be your first step in attempting to minimize the costs. When we looked at how to reduce costs for flooring, this is something we focused on, specifically by illustrating the difference between three quotes. In that example, comparing quotes provided a more accurate picture of what the most reasonable costs ought to look like. You’re not guaranteed to see significant differences when you try this for your own renovation, but it’s always worthwhile to check.

Save with a DIY Approach

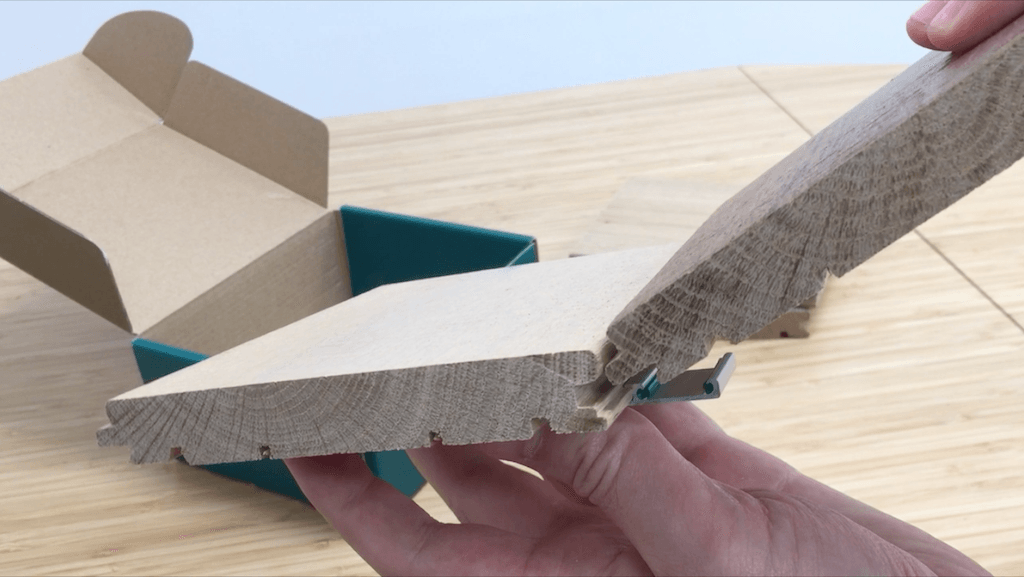

Another aspect of our look at financing a hardwood flooring project was consideration of a DIY approach. Naturally, whether or not you can take such an approach depends largely on the specific project at hand, and your own savvy with construction, decorating, and so on. Generally speaking, there are some home improvement projects better suited for DIY than others. But if you’re generally handy, or you’re good at learning on the job, DIY can save you a lot of money on labor costs. The materials will still add up, and you’ll be spending your own time on the job — but without labour costs, the financing gets a lot easier.

Secure a Home Improvement Loan

A home improvement loan is one of the most popular answers to the question of how to finance home renovations. Getting multiple quotes and looking into DIY are really about reducing potential costs. When it comes to actually financing the project though, one of the most popular and logical options is to secure a home improvement loan. This is essentially an unsecured loan you can use for home improvements, and which you apply for on the basis of your credit worthiness.

Another option is a home equity loan, which can serve a similar purpose, but for which your own equity in your home is put up as collateral. Many ultimately find a home improvement loan to be preferable because of this difference — particularly new homeowners who may not have much equity yet to begin with.

Ultimately, a home improvement loan is a strategic means of getting money now for your renovation project without functionally giving anything up for it, and then spreading out the cost in the form of instalments that pay off the loan over time.

Explore Credit Card Options

Paying for a home renovation with a credit card isn’t always a good idea. However, there are some cards and some offerings that people ultimately find intriguing — often because points and rewards can help to offset costs. So, for example, the Chase Sapphire Preferred card has been well known at times for offering a significant point bonus that amounts to some $500 cash back for users that spend $4,000 in their first three months with the card. So, in theory, if you had a $4,000 renovation and paid for it with the card, your points would ultimately get you $500 back, such that the renovation would only have set you back $3,500.

Boost Your Savings

Sometimes we can almost get too caught up in looking for ways to manage budgets or finance projects, when in the end what helps most is saving. It’s easier said than done, but you can always find helpful savings tips — from separating “wants” from “needs” to changing some day-to-day habits, and so on — that will ultimately help you set a lot of money aside. Even scraping together $100 a month that you would ordinarily spend on other things can go a long way toward covering the costs of a home renovation, particularly if you’re able to pay off the job over time.

Hopefully these tips get you a few steps closer to pulling off that home renovation you’ve always wanted. In the end, most of these projects can still be fairly costly. But with the right strategic approach, you can minimize and manage costs in a way that allows you to piece your dream home together.

Turn Your Renovation Plans into Reality

Learning how to finance a home renovation doesn’t have to feel intimidating. By comparing quotes, considering DIY, and exploring loan or credit options, you can break a large project into smaller, manageable steps. And even small changes to your savings habits can help you build a financial cushion faster than you think.

The key is to approach your renovation strategically — planning ahead, minimizing unnecessary expenses, and choosing financing methods that fit your situation. That way, you can stop delaying and finally create the home you’ve been envisioning.

👉 Thinking of upgrading your floors as part of your renovation? Order a Easiklip sample pack to experience how easy and affordable solid hardwood can be.